Source: FCC, Graeme Crosbie Senior Economist

Higher processor demand and still-low butter stocks are setting the stage for more milk production from Canadian dairy farmers in 2024. This, combined with strong culled cow/calf prices and stabilizing – though still high – input costs provide context to our average gross margin estimates for 2024, which look better than they have in the last few years (Figure 1).

*Gross margin is total revenue less total variable costs (including feed). Fixed costs and return to management are excluded from the calculation. We do not include fixed costs as these vary greatly between operations.

**The calculations use different definitions of cost categories for the P5 and WMP and therefore values are not directly comparable.

Sources: Statistics Canada, Canadian Dairy Commission, Government of Alberta, FCC Economics

In December 2023, the Western Milk Pool (WMP) announced that, effective February 1, 2024, quota increases would take effect. The increases are not distributed evenly across provinces (see Table 1) due to a ‘rebalancing’ effort to ensure all four provinces in the WMP are on an even playing field. No quota increases in eastern Canada (i.e., the P5) have been announced at this time.

| Province | Quota increase (%) |

| Manitoba | + 1.50% |

| Saskatchewan | + 2.00% |

| Alberta | + 2.25% |

| British Columbia | + 3.00% |

Source: BC Milk

Additionally, a farm gate milk price increase of 1.8% will go into effect on May 1, 2024. Between increased production and slightly higher farm gate prices, total farm cash receipts (FCR) for the dairy sector are forecast to increase 3.7% this year. Continued strong culled cow/bull calf prices in 2024 will provide an additional boost to profitability.

The top economic trends likely to impact dairy operations in 2024 include:

- Feed prices and availability

- Butter stocks

- Retail demand and inflation

Feed availability and pricing will be the ultimate determinant of profitability in 2024. A record US corn crop in 2023 sent corn prices tumbling to a three-year low, easing the burden on producer feed costs, particularly in the east. With corn being the market-maker in other feed grain markets, this put downward pressure on feed wheat and feed barley prices even where drought limited wheat and barley production. A near record amount of US corn imports this year is also helping keep a lid on feed prices in the west, though prices remain elevated. FCC Economics is forecasting feed costs to be lower in 2024 but trend higher throughout the year.

Remember that feed costs are opportunity costs; for operations that grow some or all of their own feed, costs will likely be lower than the numbers reported in below.

Sources: Statistics Canada, FCC Economics

Hay prices have been and will continue to be stickier in the west, more reflective of local market dynamics and the shortage of product. Producers will be crossing their fingers for good moisture in the spring and a strong first cut.

It’s recommended that each producer understand their own operation’s cost of production structure and identify risk management strategies to minimize risk under different feed production or feed price scenarios.

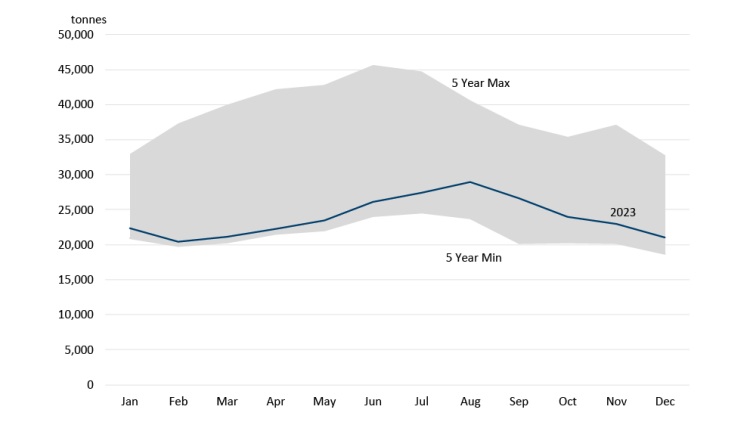

As was the case in our 2023 dairy outlook, butter stock levels are a trend to monitor this year. Butter stocks are higher than they were at this time last year but are still low relative to recent history (Figure 3).

Source: CDC

Low butter stocks leave little room for error should production not meet anticipated demand and will be a key reason why more incentive day announcements may be forthcoming for P5 producers. One incentive day has already been announced for February due to “due to a higher than usual market demand at the beginning of 2024.” Last year, there were six incentive days in the P5 when butter stocks were at near-historical lows.

Demand for dairy products continues to shift but seems to be holding up relatively well in the face of tighter consumer budgets. One reason is that dairy product prices increases in 2023 were lower than many other major food products (Figure 4).

Source: Statistics Canada

Canada’s Food Price Report 2024 forecasts that dairy product prices will increase 1 to 3 percent in 2024, tied with fruit for the lowest projected inflation rate among major food categories. If this forecast pans out, it will provide dairy products with a (relative) price advantage in the grocery aisle at a time when consumers are under extreme strain. Population growth is an additional driver of demand, helping provide a boost to sales when per capita consumption of food is declining.

Steady demand for dairy products is reflected in other data as well. On a monthly basis the Canadian Dairy Commission (CDC) estimates total requirements (TR) which is a measurement of how much butterfat is required by Canadian processors. The CDC estimates that TR grew by 2.4% in 2023, and the quota increase in the WMP was a result of anticipated increase in processor demand (i.e., TR) in 2024.

It has been a volatile few years for dairy producers but 2024 is shaping up to be calmer – a return to a more normal environment, if you will. Anticipated interest rate cuts in the second half of the year will provide further relief to producers. How the growing season unfolds in the Prairies will be the ultimate determinant of profitability for western producers.