Source: FCC

Falling input prices feature in the 2023-24 and the 2024-25 crop years, partially offsetting lower prices for many ag commodities. There’ll be more margin pressure, especially for Western crops, than the sector has seen recently. This year, we’ll be watching global stocks-to-use ratios, global weather forecasts and equipment costs as three significant influences on crop profitability.

Commodity prices for the 2023-24 marketing year (MY) have fallen year-over-year (YoY), but for corn, spring wheat, and feed barley, they may already have bottomed out (Table 1). Canadian feed barley prices have been pressured by the availability of relatively cheap U.S. corn and lack of export demand and Canada’s barley carryout is expected to be in line with the five-year average. However, low supplies due to drought-related yield reductions on the prairies will help to boost prices for the new MY and keep them well above the five-year average.

Sources: Statistics Canada and FCC calculations

Marketing Year for corn and soybeans: September 1 – August 31

Marketing Year for wheat, canola, barley, peas and lentils: August 1 – July 31

Larger global and U.S. corn supplies will continue to weigh on Canadian prices, as will increases in 2023-2024 production and imports. Despite this pressure, prices should remain above the five-year average as carryout supplies are expected to be 11% below the five-year average. Canadian non-durum wheat supplies are better than expected given 2023 prairie growing conditions, but this year’s carryout stocks are expected to be 14% below the five-year average. With export strength continuing amid low global wheat supplies and domestic use forecast in line with historical trends, 2024-2025 prices will be roughly in line to slightly higher YoY.

The 2024-25 MY shows soybean, canola, yellow pea, and lentil prices falling YoY again. Soybean and canola prices will be pressured by ample global soybean supplies going to the vegetable oil and biodiesel markets, and a possible increase in U.S. soy acres in 2024. Brazil’s soybean production is a wildcard to monitor. Peas are likely to continue falling or stabilize at lower levels, despite the recent removal of tariffs on Canadian yellow peas applied by the Indian government, as the move is temporary. Durum is expected to stabilize at last year’s prices but remain above the five-year average.

On the expense side, all fertilizer prices are expected to be lower YoY as input costs continue to stabilize. Although commodity prices are dropping, fertilizer prices are dropping more quickly, easing some margin pressure. Eastern profitability (winter wheat, corn and soybeans) will be tight but close to break-even over the three-month outlook period. Western margins will face considerably more pressure. Downside risk will come from increasing equipment and interest expenses as the sector grapples with rising costs per acre.

The top economic trends likely to impact crop operations in 2024 include:

- Global stocks-to-use ratios

- Prairie moisture levels

- Equipment costs per acre

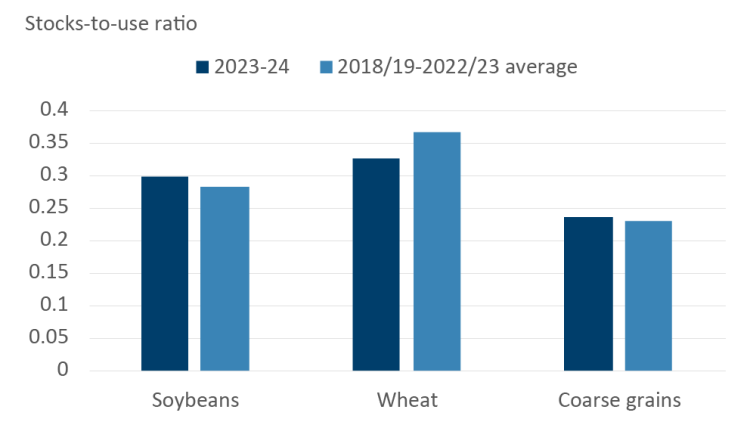

Global wheat stocks are expected to be low throughout the 23-24 MY, with a stocks-to-use ratio lower than the five-year average. That will support prices in 2024 (Figure 1). Current forecasts show high corn, coarse grains and soybean supplies, softening their prices.

Source: United States Department of Agriculture

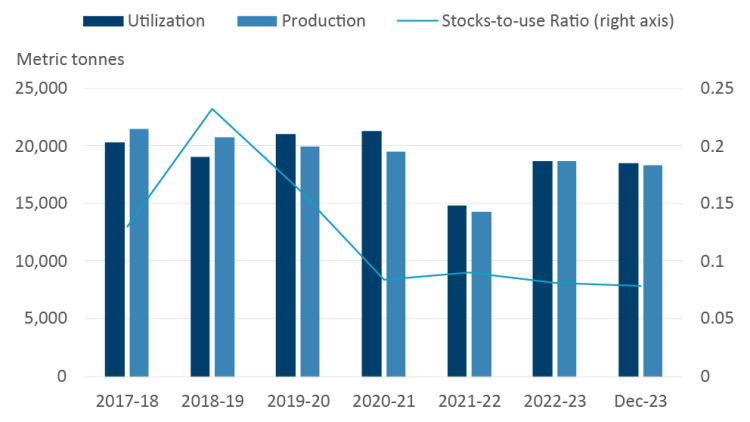

Canada’s canola stocks are tight now, down 36% YoY and 60% compared to the five-year average. Of note: domestic demand will likely increase this year as a new biodiesel plant comes online. Canada set a record for canola crush for Q1 2023-24 and it will grow with additional expansion planned. (For more, see our Top Trends post.) With the added demand, Canada’s stocks-to-use ratio could be pressured further downward (Figure 2).

Source: Statistics Canada

While Western cropland is expected to be dry heading into the winter, the AAFC drought monitor shows some relatively higher soil moisture reserves YoY. Nonetheless, the dry conditions could be exacerbated by the El Nino weather pattern, which typically means a warmer, drier winter.

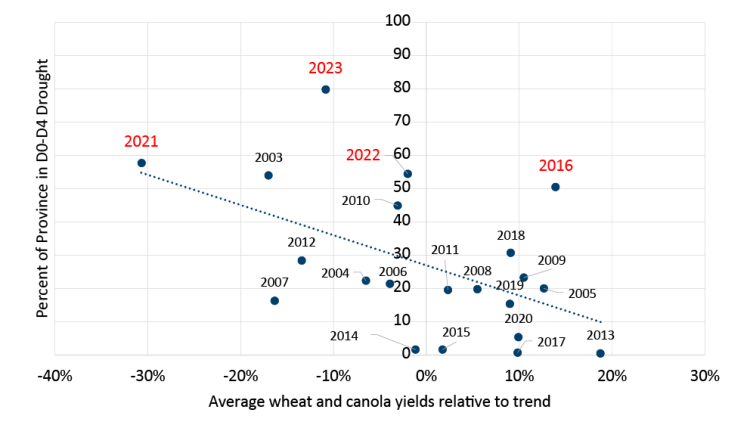

The Canadian Drought Monitor showed 100% of Saskatchewan was in some degree of drought at October 31. Historical drought data (2003 – 2023) as of February each year illustrates the impact of dry conditions on Saskatchewan’s subsequent canola and wheat yields (Figure 3).

Sources: Canadian Drought Monitor and FCC calculations

Yields were hit particularly hard in 2021 when over half of the province experienced some degree of drought as of February 28. The 2023 drought was the largest of the last 20 years, but yield impacts weren’t as severe. But 2022 and 2016 show that rains during the growing season can abate early season dryness. These yields were close to, or well above, their respective five-year trends.

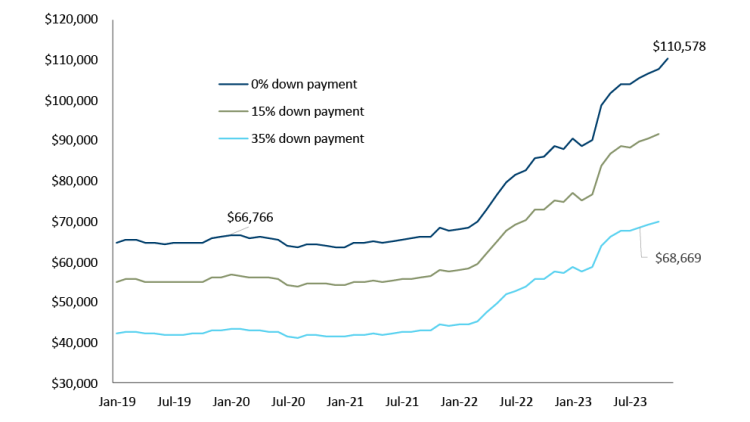

Supply chain logjams and inflationary pressures have boosted equipment manufacturing costs on raw materials and labour. As equipment prices rose in response, interest rate hikes added more expense to the cost of upgrading equipment. Commodity prices have also risen since 2020, helping to ease the burden, but with projected declines in crop prices this year, there may be extra per acre financial strain on grain and oilseed operations needing to upgrade equipment.

For example, a new class 8 combine with no header was listed at $800,000 in November 2023. Using a standard loan payment calculation for a five-year loan fixed at 6.4%, and with 0% down, the combine semi-annual payment would be over $110,000. That’s climbed 65.6%% since January 2020 (Figure 4).

Sources: Alberta farm input prices and Statistics Canada

On a per acre basis, the combine alone would cost $60 per acre (assumes 250 annual hours doing 15 acres/hour), up from $35 per acre in 2020 (assuming the through-put of the older equipment is the same as the newer model over the five-year period).