Source: University of Missouri

Joe Horner

State Specialist, Agricultural Business and Policy Extension

Ray Massey

Professor, Agricultural Business and Policy Extension

Ryan Milhollin

Assistant Professor, Agricultural Business and Policy Extension

In livestock production, gross margin is the difference between revenue from livestock or milk sales and feed costs. It is an indicator of profitability.

Livestock gross margin (LGM) insurance offers livestock producers a way to manage gross margin risk by guaranteeing a minimum gross margin. If the gross margin guarantee at the beginning of the contract period is higher than the actual gross margin at the end of the contract period, the policyholder earns an indemnity. LGM insurance protects expected gross margin rather than a selling price, which is the purpose of livestock risk protection (LRP) insurance. It does not protect against risks such as death or destruction of animals, production losses or increases in feed use.

LGM insurance is administered by the U.S. Department of Agriculture (USDA) Risk Management Agency (RMA) and sold by approved livestock insurance agents. LGM insurance uses futures prices to determine expected and actual gross margins(opens in new window). Policies are available in Missouri for cattle, dairy and swine operations.

(opens in new window)How to sign up

Livestock producers can sign up for LGM insurance weekly through livestock insurance agents. LGM insurance may only be purchased between when markets close on Thursdays and 9 a.m. Central Time the next day. The RMA reserves the right to suspend sales at any time due to market complications.

(opens in new window)Basics of LGM policies

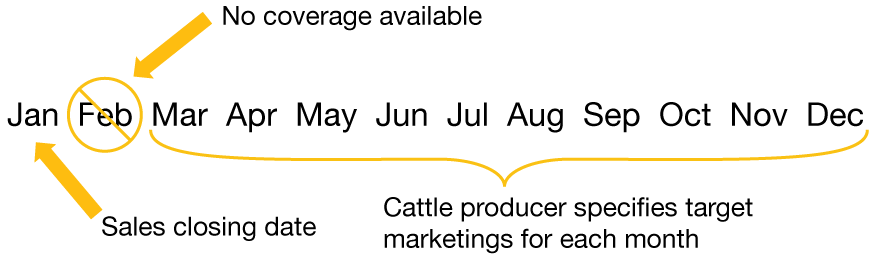

Cattle and dairy producers can insure livestock or milk to be sold two to 11 months in the future. Swine producers can insure livestock to be sold two to six months in the future. Producers identify the months in which they intend to sell their commodities, then buy coverage based on those intentions. Additionally, producers can have multiple policies by purchasing coverage at different sales closing dates. Coverage begins one month after purchase of a policy because the first month is not insurable. For example, a cattle policy purchased in January would begin insuring cattle in March and provide coverage through December (Figure 1).

To obtain a policy, a producer must fill out an application that includes identifying the type of livestock insured, the estimated number of target marketings — number of slaughter-ready head or pounds of milk for sale — during the insurance period, and the deductible amount. Along with the application, a producer must complete a substantial beneficial interest (SBI) form. This form requires that the applicant document at least 10 percent ownership of the livestock to be insured and identify all other owners. Premiums are due in the last month of the insurance period, but can be paid through indemnities.

After insurance is purchased, the policyholder must submit marketing reports to document actual marketings over the course of the insurance period.

With coverage in place, indemnities are determined based on expected gross margin, actual gross margin and deductibles. Any indemnity payments are made after the last month of the producer’s LGM policy. Indemnities will deduct premium costs before making a producer payment. Producers can use both LRP and LGM insurance policies, and they cannot be used to cover the same livestock.

To determine possible benefits from LGM insurance, one must look at the rules and options pertaining to each of the three policy options: cattle, swine and dairy.

Cattle policy

LGM insurance for cattle is available for calf-finishing and yearling-finishing operations (Table 1). A yearling-finishing operation will assume an initial weight of 750 pounds and market weight of 1,250 pounds. A calf-finishing operation will assume an initial weight of 550 pounds and market weight of 1,150 pounds. There is no minimum amount of cattle that can be insured. Premium subsidies range from 18 percent to 50 percent, dependent on the deductible selected by the producer.

Table 1. LGM-Cattle snapshot.

| Covered operations | Yearling- or calf-finishing operations |

|---|---|

| Deductibles | $0 to $150 per head in $10 increments |

| Premiums due | At the end of the insurance period |

| Insurance period | Up to 11 months |

| Gross margin factors | Feeder cattle, corn and live cattle futures |

| Subsidies | 18 percent with $0 deductible up to 50 percent with a deductible of $70 or greater |

Gross margin is calculated by subtracting costs of feeder cattle and feed from the market value of cattle. For the purposes of calculating gross margin, feed quantity is established in the insurance contract and is not dependent on the producer’s actual feed use. CME futures contract prices for feeder cattle, corn and live cattle are used to determine the gross margin guarantee and actual gross margin. In months when there are no futures prices for feed or livestock, the USDA estimates the price of feed and livestock using the futures prices of surrounding months. The calculations and appropriate futures contract months used to determine gross margin are found in Table 2.

Table 2. Cattle gross margin calculations.

| Live cattle price | Yearling-finishing operation | Calf-finishing operation |

|---|---|---|

| Market value equation | 12.5 cwt × live cattle futures price | 11.5 cwt × live cattle futures price |

| Contract month | When marketed | When marketed |

| Feeder cattle price | Yearling-finishing operation | Calf-finishing operation |

| Feeder calf equation | 7.5 cwt × feeder cattle futures price | 5.5 cwt × feeder cattle futures price |

| Contract month | 5 months before marketing | 8 months before marketing |

| Feeder (corn) price | Yearling-finishing operation | Calf-finishing operation |

| Cost of feed equation | 50 bu × corn futures price | 52 bu × corn futures price |

| Contract month | 2 months before marketing | 4 months before marketing |

For example, a yearling finishing producer elected an LGM policy in March with a $20 per head deductible for cattle to be sold in October. The RMA reported the expected gross margin at the time of sale was $200 per head for the month of October. After applying the $20 deductible, gross margin guarantee would be $180 per head. Feeder cattle futures were $185 per hundredweight in May, corn futures were $6.80 per bushel in August, and live cattle futures were $155 per hundredweight in October. Actual gross margin would be calculated as follows:

(12.5 cwt × $155 live cattle futures price) – (50 bu × $6.80 corn futures price) – (7.5 cwt × $185 feeder cattle futures price) = $210 per head

Because the guaranteed gross margin ($180) is less than the actual gross margin ($210), the producer receives no indemnity. Producers should account for the premium cost to determine their net gain or loss from the program.

Swine policy

Hog farmers can use LGM insurance to protect gross margin of farrow-to-finish, feeder finishing and segregated early weaned (SEW) finishing production (Table 3). Swine are not insurable in the first month and are expected to be marketed at 260 pounds live weight. To convert from live weight to dressed weight, use the lean conversion factor of 0.74. There is no minimum coverage level for swine policies. Each insurance period is six months long. Premium subsidies range from 18 percent to 50 percent, dependent on the deductible selected by the producer.

Table 3. LGM-Swine snapshot.

| Covered operations | Farrow-to-finish, feeder-to-finish and segregated early weaned (SEW) operations |

|---|---|

| Deductibles | $0 to $20 per head in $2 increments |

| Premiums due | At the end of the insurance period |

| Insurance period | Six months |

| Gross margin factors | Lean hog, corn and soybean meal futures prices |

| Subsidies | 18 percent with $0 deductible up to 50 percent with a deductible of $12 or greater |

Calculate gross margin by subtracting feed costs from the market value of swine. For the purposes of calculating gross margin, feed quantity is established in the insurance contract and is not dependent on the producer’s actual feed use. CME futures contract prices for lean hogs, corn and soybean meal are used to determine the gross margin guarantee and actual gross margin. The calculations and appropriate futures contract months used to determine gross margin can be found in Table 4.

Table 4. Swine gross margin calculations.

| Lean hog price | Farrow-to-finish operation | Feeder-to-finish operation | Segregated early weaned (SEW) operation |

|---|---|---|---|

| Market value equation | Swine lean hog futures price × 0.74 × 2.6 cwt | Swine lean hog futures price × 0.74 × 2.6 cwt | Swine lean hog futures price × 0.74 × 2.6 cwt |

| Contract month | When marketed | When marketed | When marketed |

| Feeder (corn and soybean meal) prices | Farrow-to-finish operation | Feeder-to-finish operation | Segregated early weaned (SEW) operation |

| Cost of feed equation | (12 bu × corn futures price) + (138.55 lb ÷ 2,000 × soybean meal futures price) | (9 bu × corn futures price) + (82 lb ÷ 2,000 × soybean meal futures price) | (9.05 bu × corn futures price) + (91 lb ÷ 2,000 × soybean meal futures price) |

| Contract month | 3 months before marketing | 2 months before marketing | 2 months before marketing |

For example, a producer with a farrow-to-finish operation took out an LGM policy with a $2 per head deductible for pigs to be sold in April. The RMA reported the expected gross margin at the time of sale was $50 per head for April, so the gross margin guarantee would be locked at $48 per head after applying the deductible. January corn and soybean meal futures were $6.80 per bushel and $400 per ton respectively, and lean hog futures for April were $85 per hundredweight. Actual gross margin would be calculated as follows:

($85 lean hog futures price × 0.74 conversion factor × 2.6 cwt) – (12 bu × $6.80 corn futures price) – (138.55 lb ÷ 2,000 tons × $400 soybean meal futures price) = $54.23 per head

Because the guaranteed gross margin ($48) is less than the actual gross margin ($54.23), the producer receives no indemnity. Producers should also account for a policy’s premium costs to determine their net gain or loss from using the LGM program.

Dairy policy

Dairy operations can be covered under LGM-Dairy (Table 5). These policies contain subsidies to reduce premium payments, but you must insure at least two months during the 11-month insurance period to qualify for a subsidy. The amount of the subsidy is determined by the deductible the producer chooses for the insurance plan. Deductibles range from $0 to $2 per hundredweight in increments of $0.10, and subsidy rates range from 18 to 50 percent of the premium cost. For example, a deductible of $0.00 will receive a subsidy of 18 percent, and a deductible of $1.10 or higher will receive a subsidy of 50 percent. Dairy premiums are due at the end of the insurance period. There is no minimum or maximum for the hundredweight of milk insured per month.

Table 5. LGM-Dairy snapshot.

| Covered operations | Milk sold for commercial or private sale for human consumption |

|---|---|

| Deductibles | $0 to 2 per cwt in $0.10 increments |

| Premiums due | At the end of the insurance period |

| Insurance period | Two to 11 months |

| Gross margin factors | Milk (Class III), corn and soybean meal futures contracts |

| Subsidies | 18 percent with $0 deductible up to 50 percent with a deductible of $2 |

Gross margin is calculated by subtracting feed costs from the market value of milk. CME futures contract prices for corn, soybean meal and Class III milk are used to determine the gross margin guarantee and actual gross margin (Table 6). Under LGM-Dairy, cost of feed may depend on the producer’s predicted use. Cost of feed is determined by corn and soybean meal equivalents.

Table 6. Dairy margin calculations.

| Milk prices | Dairy operation |

|---|---|

| Market value equation | Class III milk futures price × cwt |

| Contract month | When marketed |

| Feeder (corn and soybean meal) prices | Dairy operation |

| Cost of feed equation | (Corn or equivalent tons fed × corn futures price × 2,000 ÷ 56 conversion factor) + (Soybean meal or equivalent tons fed × soybean meal futures price) |

| Contract month | When marketed |

For example, a dairy farmer elects an LGM policy with a $1 per hundredweight deductible for 1,000 hundredweight of milk to be sold in April. The farmer uses the default values of 0.014 tons of corn per hundredweight and 0.002 tons of soybean meal per hundredweight for their cost of feed. Multiplying the default values by the volume of milk to be sold (1,000 cwt) would set the target feed levels at 14 tons of corn and 2 tons of soybean meal. Expected futures prices at the sales closing date for Class III milk were $20.25 per hundredweight, corn at $6.80 per bushel and soybean meal at $400 per ton. Based on these expected values, the expected gross margin would be calculated as follows:

Determine expected cost of feed:

(14 tons × 2,000 lb/ton ÷ 56 lb/bu corn × $6.80 per bushel corn price) + (2 tons × $400 per ton soybean meal price) = $4,040 expected cost of feed per 1,000 cwt (or $4.04 per cwt)

Determine expected milk revenue:

$20.25 per cwt milk price × 1,000 cwt = $20,250 expected milk revenue

Determine expected gross margin:

$20,250 – $4,040 = $16,210 expected gross margin per 1,000 cwt (or $16.21 per cwt)

After factoring in the $1 per hundredweight deductible, the gross margin guarantee would be $15.21 per hundredweight. Actual futures prices in April for Class III milk were $17.25 per hundredweight, $7 per bushel for corn and $420 per ton for soybean meal. Actual gross margin would be calculated as follows:

Determine actual cost of feed:

(14 tons × 2,000 lb/ton ÷ 56 lb/bu corn × $7 per bushel corn price) + (2 tons × $420 per ton soybean meal price) = $4,340 actual cost of feed per 1,000 cwt (or $4.34 per cwt)

Determine actual milk revenue:

$17.25 per cwt milk price × 1,000 cwt = $17,250 actual milk revenue

Determine actual gross margin:

$17,250 – $4,340 = $12,910 actual gross margin per 1,000 cwt (or $12.91 per cwt)

The difference between the expected gross margin after accounting for the deductible and actual gross margin would result in an indemnity payment of $2.30 per hundredweight ($15.21 – $12.91) for a total payment of $2,300 ($15,210 – $12,910). Producers should account for the producer paid premiums to determine their net gain or loss from using the program.

Under the 2018 Farm Bill, dairy producers can insure their dairy margins with the Dairy Margin Coverage (DMC) program through the USDA Farm Service Agency. Producers can insure milk under both DMC and LGM-Dairy. Producers can also use LGM-Dairy and Dairy Revenue Protection (Dairy-RP) in the same crop year, but only one policy, either LGM-Dairy or Dairy-RP, can have endorsements in effect for the same quarterly insurance period.

Additional resources

For more information on LGM plans, contact a livestock insurance agent to help you find a policy that will best fit your operation.

These resources provide RMA data on LGM coverage, premiums and resources, as well as help finding a nearby insurance agent: