Source: Government of Alberta

“Weekly updates from the Canadian Grain Commission (CGC) provide useful crop movement and demand information,” says Neil Blue, provincial crops market analyst with the Alberta government.

The CGC statistics include volumes of bulk crops moved through facilities licensed by the Commission.

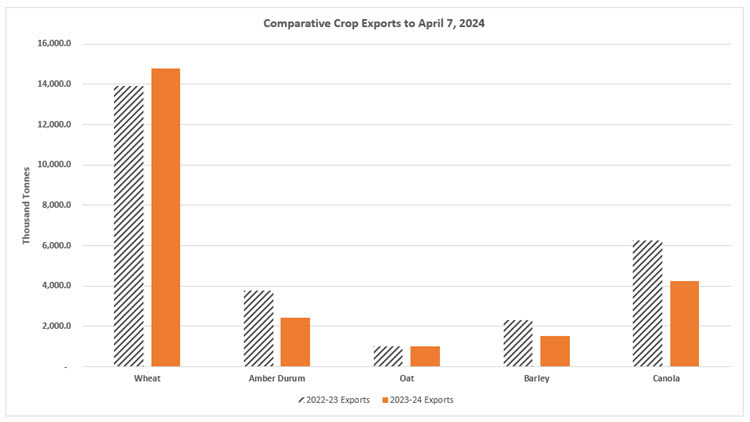

“Canadian wheat exports, although at lower prices than year ago, have been the crop export star, outpacing last year’s exports by 6%. The strong wheat exports are a likely reflection of Canada’s available supply of high-quality wheat and weakness in our dollar relative to that of the U.S.”

Figure 1. Comparative Crop Exports to April 7, 2024

Canadian durum exports, down by 35% this crop year to date, have been hampered by an increased durum supply from Turkey, and Canada’s competitive freight disadvantage to Mediterranean region durum importers. Canada, the world’s largest oat exporter, is exporting a similar oat volume as last crop year so far.

Barley and canola exports are significantly lower than the year ago pace, down 34% and 32% respectively. Competition from Australian sourced exports are the main reason for the drop in barley and canola exports.

“If the lower barley and canola exports continue, that is a drag on potential price improvement for these crops,” explains Blue. “However, seasonal sensitivity to growing season weather should provide some pricing opportunities for crops in general during May into July.”

Pea exports have notably risen to a level 18% above year ago, due to a temporary lifting of pea import restrictions by India.

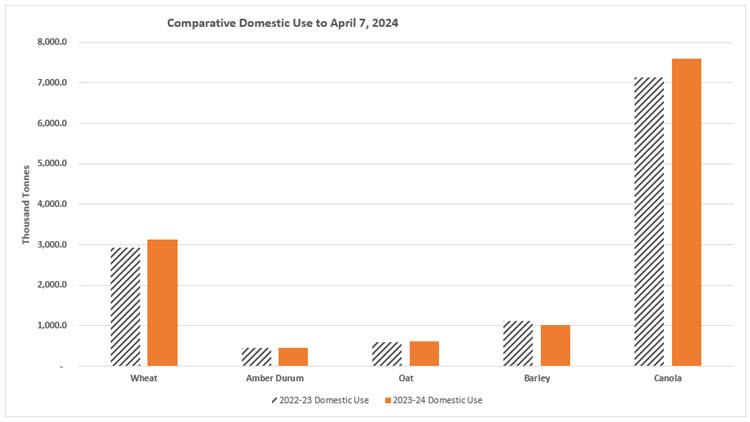

“While Canadian canola exports have been disappointing this crop year, domestic use of canola by crushers is potentially headed for a record-high volume,” says Blue.

Figure 2. Comparative Domestic Use to April 7, 2024

Following recent expansion of Canada’s oilseed crushing industry, and with additional crushing capacity under construction, domestic canola consumption via crushing during the current crop year is 6% above year ago. Steady domestic demand for the other major Canadian crops is resulting in domestic disappearance at similar levels to last crop year.

“Following the Canadian crop disappearance levels is one aspect of assessing market condition for crops and the potential for forward pricing opportunities,” says Blue.