Source: U.S. Dairy Export Council

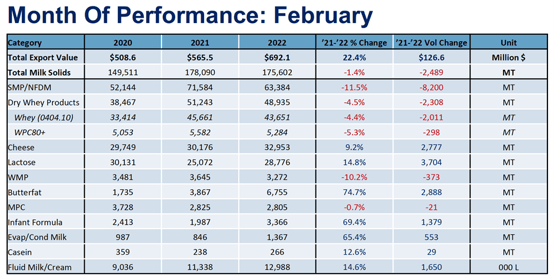

U.S. export value sets February record, reaching nearly $700 million.

Year-over-year U.S. dairy export value surged 23% in February, fueled by elevated international commodity prices and strong sales of higher-value products like cheese. At $696.8 million, U.S. suppliers set a February record.

U.S. export volume, however, posted its third straight monthly shortfall. Strong U.S. shipments of cheese, butterfat and lactose came close to offsetting declines in milk powder and whey, but fell just shy. The result: a 1% drop in U.S. export volume (milk solids equivalent) compared to the previous year.

U.S. shipments of butterfat jumped 75% to 6,755 MT. That was the biggest month for U.S. butterfat exports in nearly eight years, since April 2014. U.S. lactose exports grew 15% to 28,776 MT, and cheese gained 9% to 32,953 MT.

Nonfat dry milk/skim milk powder (NFDM/SMP) exports fell 11% (-8,200 MT) to 63,382 MT. Declines to the top two U.S. milk powder markets—Mexico (-5%, -1,296 MT) and Southeast Asia (-12%, -3,528 MT)—led the decline, but shipments were down to most major buyers.

Reduced Chinese demand continues to dampen U.S. whey exports, but overall volume in February finished better than expected, slipping only 4.5% (-2,308 MT). There were some encouraging signs in whey in February, including a 14% increase in modified whey shipments and a much stronger buying presence by Japan in the WPI sector. In February, U.S. WPI exports declined 5%, primarily due to a 67% drop in WPI shipments to China (-1,498 MT). Japan, however, increased WPI purchases from the U.S. by 164% (+1,010 MT).

For a recap of cheese performance and a look at Mexico, read on.

Cheese sets February record – Paul Rogers

U.S. cheese suppliers shipped 32,953 MT in February, setting a record for the month and extending the year-over-year growth streak to eight consecutive months. February volume topped the previous year by 9% (+2,777 MT).

Japan led the increase (+59%, +1,401 MT), but almost all major markets posted gains: Mexico +5% (+394 MT); Central America +26% (+527 MT); Southeast Asia +39% (+661 MT); South America +32% (+422 MT, rebounding from a lackluster January); the Caribbean +30% (+369 MT); and South Korea +4% (+204 MT).

U.S. cheese sales to the Middle East/North Africa fell 22% (-596 MT), but that was against a very strong February 2021 when U.S. suppliers shipped 2,687 MT to the region.

.jpg?width=554&name=Cheese%20chart%20for%20Feb%20trade%20stats10%20(4).jpg)

Global cheese demand remains strong, and tight supply and favorable pricing continue to benefit U.S. suppliers. Much of the U.S. cheese growth in February came from a 59% increase in cheddar volume, which is being primarily driven by competitive pricing, available supply and good demand.

Through the first two months of the year, U.S. cheese shipments were up 13%, and the United States has gained share on our two major competitors: the EU and New Zealand. New Zealand cheese exports through February were down 6.5% vs. the first two months of 2021; EU cheese exports in January (latest data available) fell 3%.

February Contraction for Mexico – Stephen Cain

The recovery in U.S. dairy exports to Mexico has somewhat stalled as of late. In February, overall U.S. dairy exports to Mexico contracted 10% (-3,987 MT) in terms of milk solids equivalent but jumped 28% in value. Strong prices helped boost overall growth in value of exports despite the decline in volume.

Year-over-year U.S. NFDM/SMP exports to Mexico dropped 5% (-1,296 MT) in February, while whey product shipments fell 25% (-894 MT). Cheese (+5%, +394MT), lactose (+18%, +400 MT) and butterfat (+133%, +508 MT) all gained.

Conflicting factors are buffeting demand for dairy imports. On the one hand, Mexican milk production has been stumbling. Despite official statistics stating production has been consistently up around 2% over the last year, we hear that many processing facilities are struggling to run at full capacity, with some running as much as 40% below capacity.

While the government remains optimistic about milk production in 2022, Mexico’s leading dairy trade association, Femeleche, has pushed back against the official statistics and expects production to be down by 3.3% this year. This tighter domestic environment for milk is supportive of U.S. imports into the country, and it is likely to continue in 2022. However, a strong dollar could still temper demand.

While the peso has strengthened against the U.S. dollar in the last few weeks, it’s still near some of the weakest levels it’s been against the dollar in years. A peso that doesn’t stretch quite as far as it used to stretch may challenge U.S. exports.

In addition to the challenging currency environment, prices are also likely testing Mexican buyers’ willingness to pay, especially for NFDM. NFDM prices are roughly 34% higher today than they were six months ago and 55% higher than they were a year ago. Despite the tighter domestic milk environment in Mexico, these higher prices may be pushing buyers to limit their purchases, buy only what they need in the near term, and push off heavier volumes in the hopes that prices will come down.